Awareness: The current and future state of decision making and the value, stages, and philosophy of BDBO including its need for a community of action

Current state

The current state of decision making is reflected in my summary of government announcements about decision making since March 2022 here (below) which consistently flags major shortcomings including:

poor-quality business cases hinder informed decisions by Cabinet and Ministers.

weak agency capability, over-reliance on consultants, and inadequate strategic and investment planning

the need for more coordinated, long-term, and evidence-based planning — using tools like the Better Business Case (BBC) framework, Living Standards Framework, and CBAx.

the lack of transparency, value-for-money assurance, and alignment between goals, and public outcomes.

unclear investment goals, compounded by fiscal pressure, declining public trust, and fragmented planning across agencies.

It calls for a joined-up, capability-driven, and accountable public investment system that links strategy, planning, and measurable public value.

So, what will it take for Public leaders to develop a joined-up approach to provide free and frank medium to long term advice (strategic thinking and tactical planning) to address problems or achieve vision, with trade-offs using Treasury CBAx and Living Standards Framework?

More specifically:

How to draw on local intelligence, not just top-down approaches by having those difficult conversations about what the problem is and what the options are that could solve the problems?

How to enable central and local government Public Leaders to think in a joined-up way to provide free and frank medium-to-long-term advice to consider options to achieve their vision for their district, region and nation:

economic (e.g. primary, secondary, tertiary, quaternary and quinary)

environmental (e.g. minimum, moderate or maximum standard)

social and cultural (e.g. provider centric or citizen centric)

How to encourage and enable central and local Government Public Leaders to make decisions on those options with limited resources to maximize the delivery of more effective services and provide medium to long term public value benefits?

How to encourage and enable central government Public Leaders to provide free and frank medium-to-date-med-term advice on those options (based on section 32 of the State Sector Act) and to provide that advice with trade-offs and using Treasury CBAx not just Living Standards Framework?

How to encourage and enable central and local Government Public Leaders to measure and publicly report economic, environmental, social and cultural benefits, based on the NZ Treasury Living Standards Framework and CBAx, to ensure the options invested in are on track to achieve the outcomes/benefits and therefore their vision for their district, region and country?

Future state

The future state of decision making needs to address the why, what, when, how and who of decision making, firstly by imagining:

Imagine a vision of “Resilient relationships and good decision making enabling resilient suburbs, organisations, districts and regions” (The Why)

Imagine a business case that describes a compelling vision (strategic case), describes the best value option to achieve the vision, (economic case), and describes how the preferred option can be procured well (commercial case), is affordable (financial case) and will be delivered well (management case). (The What)

Imagine staged decision making…Starts with a vision (Policy) comprising Programmes (to each achieve an outcome) and the constituent Projects (for service improvement) for a “start-up” decision. Then for project/s an “initiate” decision to formally approach the market. Then for project/s an “implement” decision to Procure and proceed to implementation. (The When)

Imagine decision makers setting a vision, outcome or service improvement needed being confident there is the capability to think through the development of the business cases in a holistic, systematic and relational way (The How)

Imagine clear communication of the vision, outcome or service improvement from decision makers who lead, steward, and coordinate with courage. Imagine commitment and capability of those involved in the “How” to be open and transparent, navigating ambiguity with courage, collaborating with and learning from others, and intentionally communicating etc.(the principles). Imagine clear public reporting and accountability that the investment will achieve benefits because of improving services, improving outcomes or achieving the vision (The Who)

WE need to think in a joined-up way to think medium-to-long-term how to achieve vision for an organization, a district, region and country:

WE need a decision system that enables government to participate with the public who are part of a resilient community to achieve vision by thinking together using their different strengths, resulting in measurable benefits that will reduce demand on government criminal justice, benefits and mental health, and eliminate systemic poverty. Government needs to consider its role in building resilient communities so those communities can in turn speak with their voices into decision making. That approach needs to be holistic, systematic, and relational. WE need to courageously and transparently navigate the ambiguity of difficult conversations by intentionally leaning in to listen and learn from each other, to build trust and confidence, to set a vision and identify the best value, affordable and achievable way to achieve that vision.

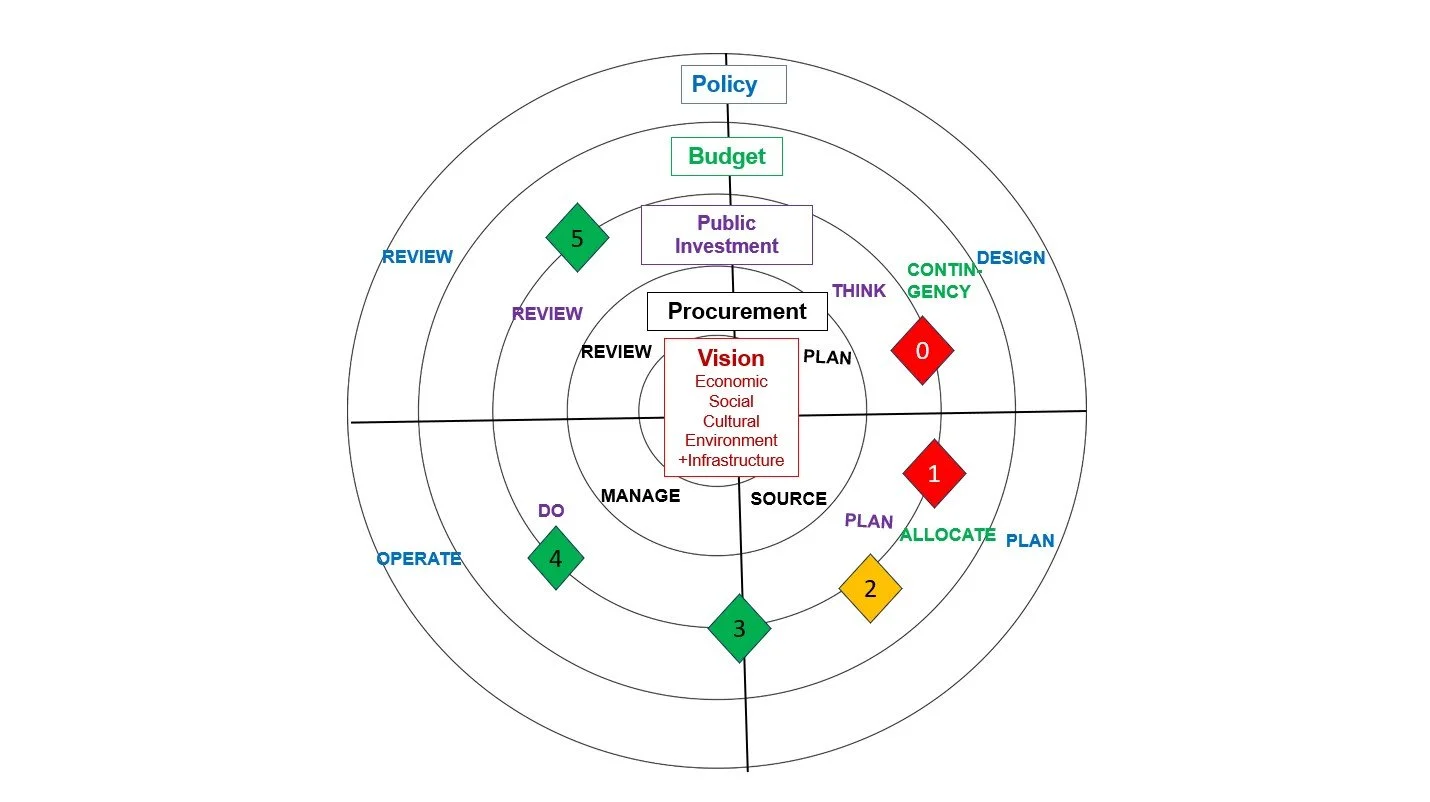

The system needs to shows clear decisions stages across the phases of the Policy, Budget, Public Investment and Procurement decision making processes. The decision stages are start up, initiate, implement, manage and review, all to achieve the vision.

Figure 1: Public investment management system

BDBO addresses the why, what, when, how and who of decision making in the think phase. The 5 BDBO stages carefully set out the importance of engaging the right people in the right way (who) to think together to develop a business case (what) to inform a startup decision (when) that gives confidence the vision can be achieved (why).

1. Governance and alignment, to confirm alignment of decision makers to agree to and how to think in a holistic, systematic and relational way for the medium to long term for the development a Portfolio Business Case to inform start-up decision (and alignment to other decision-making processes) and agree a vision. A community of action!

2. Capability Development: Provide an overview session for decision makers, an Awareness session for those attending the workshops and a Knowledge content session for the business case team to tailor the strategic and economic cases of the generic portfolio business case to inform the workshops and a Knowledge application session for the business case team so they all know how and when their capabilities will be needed and how they can be involved early.

3. Portfolio development and identification: Strategic Case workshop to test the strategic case of the portfolio business case and Economic case workshop for each programme including identification of preferred programme and how best to consolidate programmes at Portfolio Level.

4. Portfolio creation and prioritization. Confirm Portfolio Options (Survive, Revive, Thrive) and discuss CBA on short listed Portfolio options, preferred option and way forward.

5. Plan and finalise: For preferred option develop outline Commercial Case, Financial Case and Management Case

Figure 2 shows the six decision stages in each of the Think, Plan, Do, and Review phases of the public investment management lifecycle and how they correspond to the equivalent phases in budget, policy, and procurement decision-making processes.

Stage 0 – Start-up: Establish a portfolio and decide the right programmes to achieve the vision.

Stage 1 – Start-up: Establish each programme and decide the right projects to improve the outcome.

Stage 2 – Initiate: Begin a project to formally engage the market to improve services.

Stage 3 – Implement: Start the project to implement the improved services.

Stage 4 – Do: Manage the improved service.

Stage 5 – Review: Review how well the project was implemented and evaluate whether expected benefits were realised.

Figure 2: Decision stages in the Think, Plan, Do, and Review phases of the public investment management lifecycle